nebraska sales tax rate changes

Revenue Impact of a Sales Tax Rate Change. Nebraska has announced local sales and use tax rate changes effective July 1 2021.

Motor Fuels Tax Rate.

. New rates were last updated on 712021. When a tax rate is changed economists calculate how much the tax will either increase or decrease the. The Nebraska state sales and use tax rate is 55 055.

A new 05 local sales and use tax takes effect bringing the combined rate to 6. The Arapahoe sales tax has been changed within the last year. The Total Rate column has an for those municipalities.

Several local sales and use tax rate changes will take effect in Nebraska on July 1 2019. See the County Sales and Use Tax Rates section at the end of this listing for information on how these counties are treated differently. Nebraska Historic Tax Credit.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Nebraska Department of Revenue. Local Rate Changes Humphrey will increase its rate from 15 to 2.

In Lincoln the local sales and use tax rate will jump from 15 to 175. Municipal Boundary Changes Beginning July 1 2021 the following cities have modified their bounda. Click here to find other recent sales tax rate changes in Nebraska.

Several local sales and use tax rate changes took effect in Nebraska on January 1 2019. Interactive Tax Map Unlimited Use. 2018 Charitable Gaming Annual Report.

There are a total of 334 local tax jurisdictions across the. Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage County each impose a tax rate of 05. The 55 sales tax rate in Nemaha consists of 55 Nebraska state sales tax.

You can print a 55 sales tax table here. 800-742-7474 NE and IA. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

The following are recent sales tax rate changes in Nebraska. It was raised 05 from 65 to 7 in April 2022. Edward will increase by 15 bringing the combined rate to 7.

The corporate tax rate for the first 100000 of Nebraska taxable income remains. 2022 Nebraska Sales Tax Changes Over the past year there have been eighteen local sales tax rate changes in Nebraska. Local sales and use tax rate changes have been announced for Nebraska effective October 1 2015.

536 rows Nebraska Sales Tax55. Because this paper recommends reducing Nebraskas state sales tax rate as part of comprehensive tax reform it would be essential for policymakers to be able to assess the cost of these changes. Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax bringing the total sales and use tax rate in each city to 65.

Nebraska Department of Revenue. Changes in Local Sales and Use Tax Rates Effective July 1 2021 No Changes in Local Sales and. 2017 Nebraska Tax Incentives Annual Report.

2 lower than the maximum sales tax in NE. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15. Manley will start a new tax at a rate of 05.

Sales and use tax in the city of St. Old rates were last updated on 412021. The local sales and use tax rate in Chadron will increase from 15 to 2.

January 2019 sales tax changes. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

The Nebraska state sales and use tax rate is 55 055. Also effective October 1 2022 the following cities. For tax rates in other cities see.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. There is no applicable county tax city tax or special tax. Ad Lookup Sales Tax Rates For Free.

The state sales tax rate in Nebraska is 55 but you can customize this table as needed. More are slated for April 1 2019. Corporate Tax Rate Change LB 432 For taxable years beginning on or after January 1 2022 LB 432 reduces the corporate tax rate for Nebraska taxable income in excess of 100000 from 781 to 750 in tax year 2022 and to 725 for tax year 2023 and beyond.

Average Sales Tax With Local. Nebraska Sales Tax Rate Finder. 800-742-7474 NE and IA.

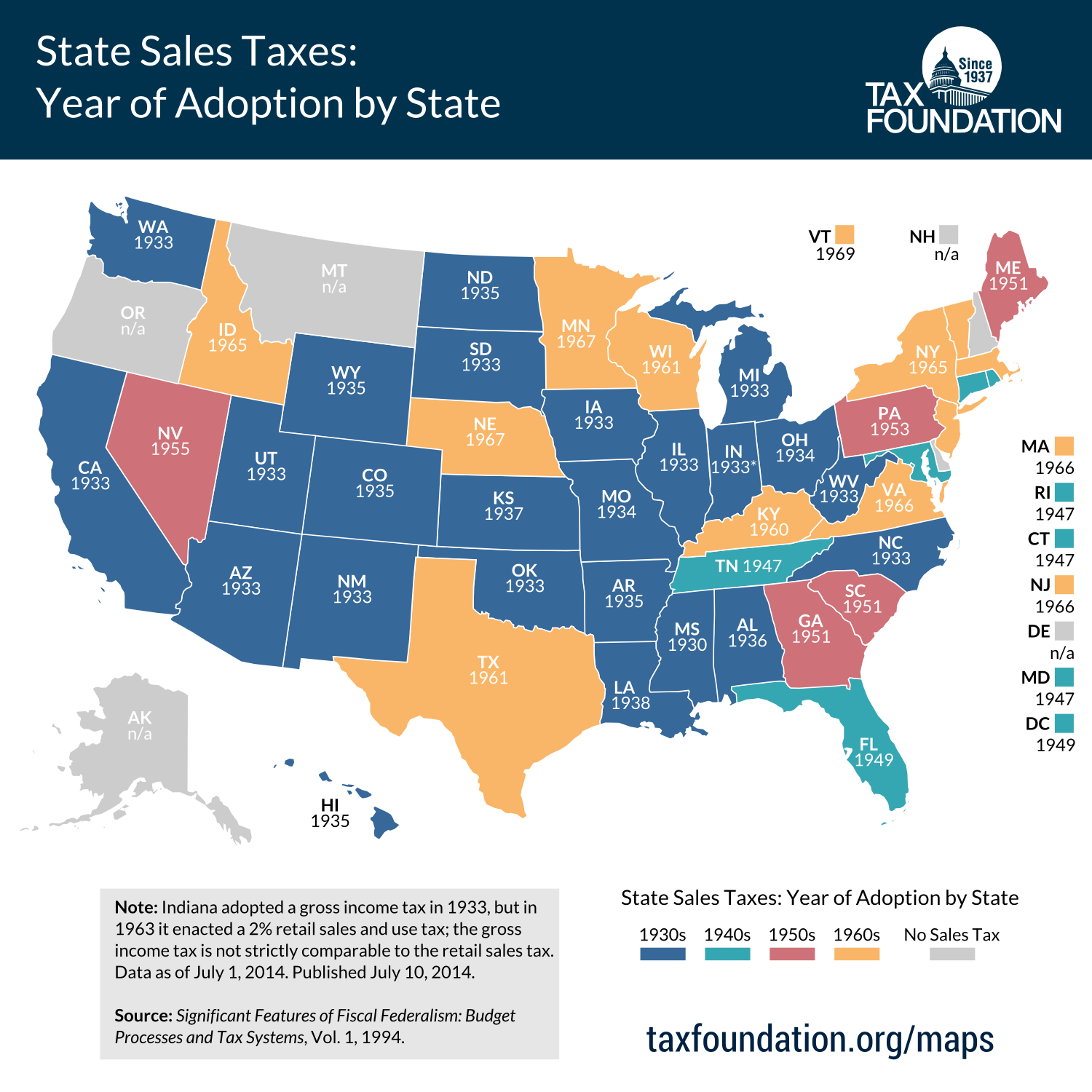

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

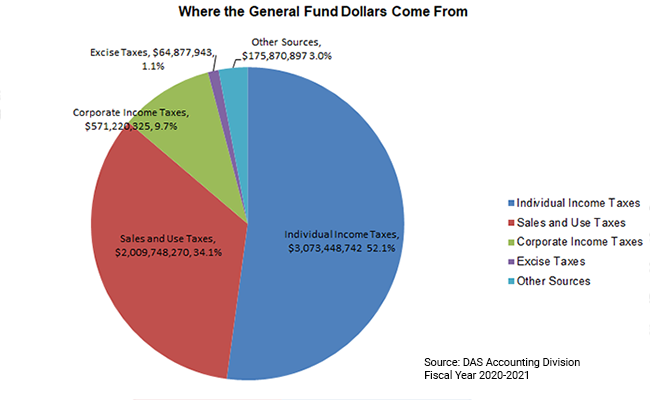

General Fund Receipts Nebraska Department Of Revenue

Sales Tax By State Is Saas Taxable Taxjar

The Top Tax Rate Has Been Cut Six Times Since 1980 Usually With Democrats Help The Washington Post

General Fund Receipts Nebraska Department Of Revenue

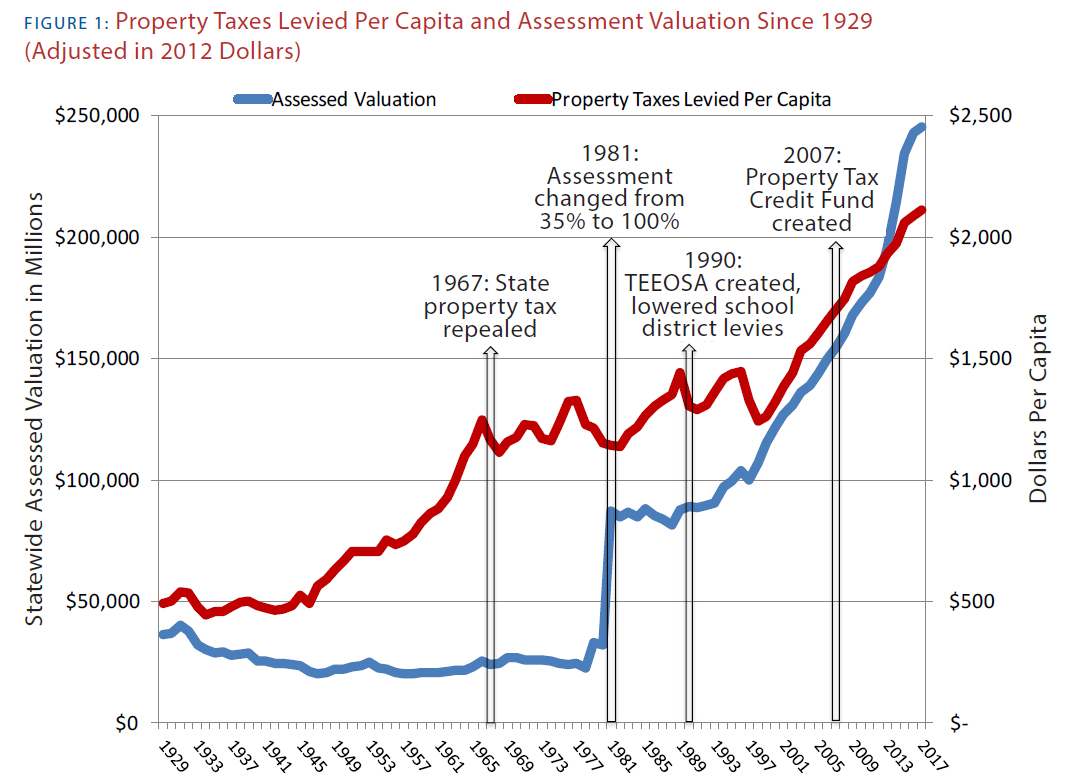

2020 Nebraska Property Tax Issues Agricultural Economics

Nebraska Sales Tax Rates By City County 2022

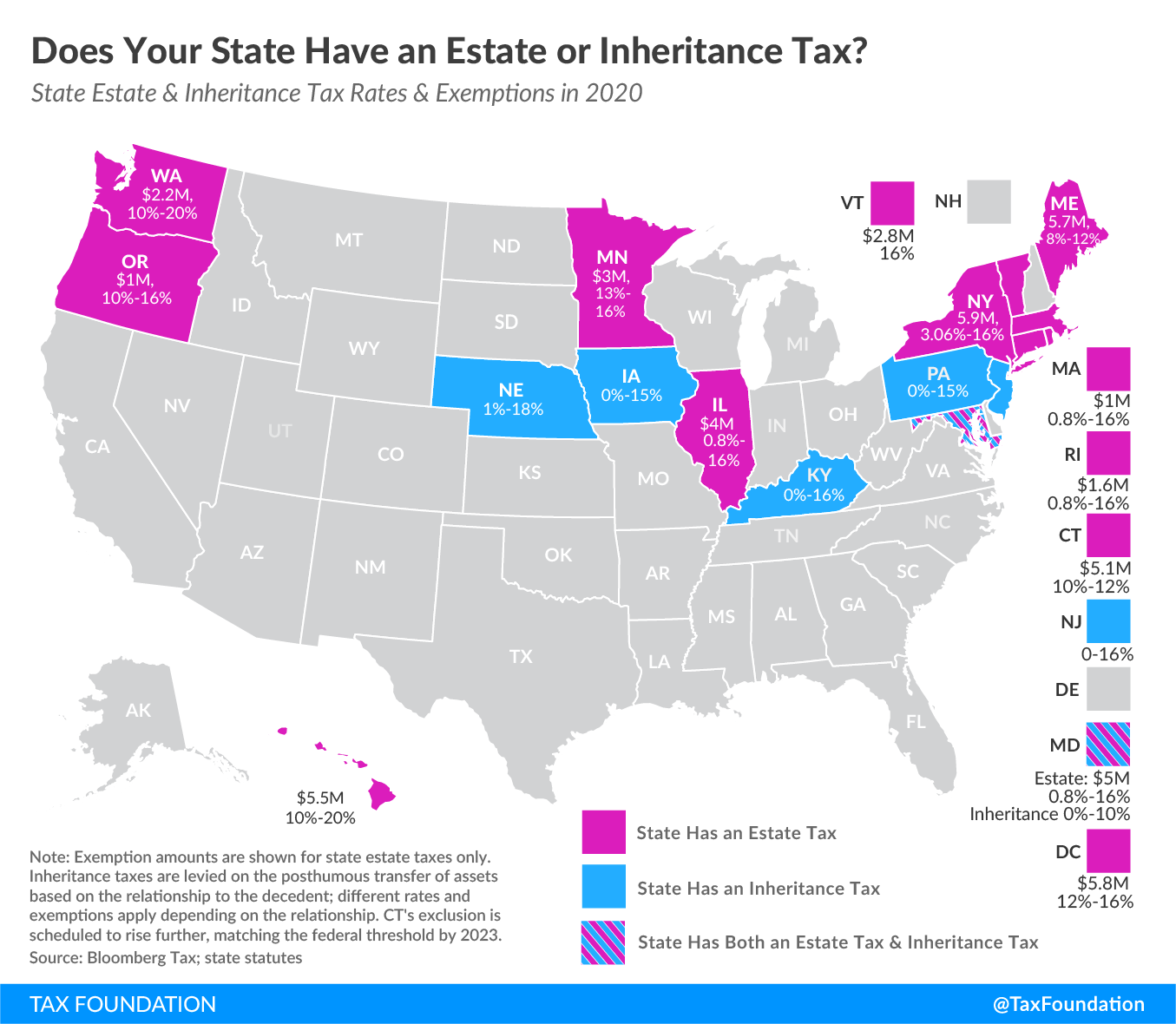

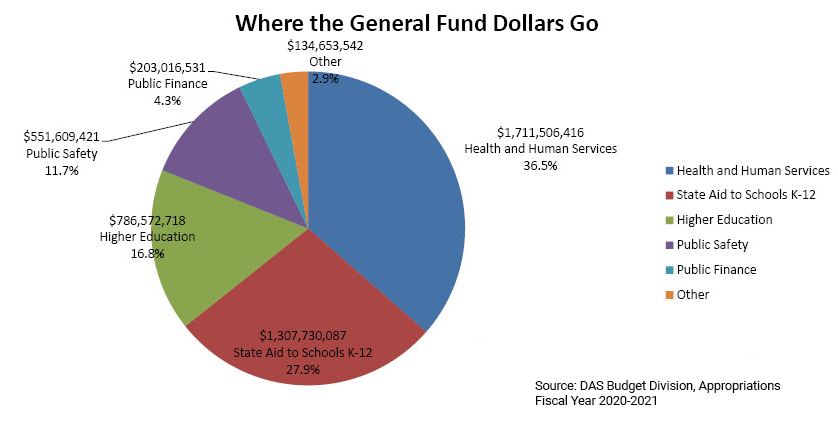

Taxes And Spending In Nebraska

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise

Compared To Rivals Nebraska Takes More From Taxpayers

States With Highest And Lowest Sales Tax Rates

How High Are Cell Phone Taxes In Your State Tax Foundation

Taxes And Spending In Nebraska

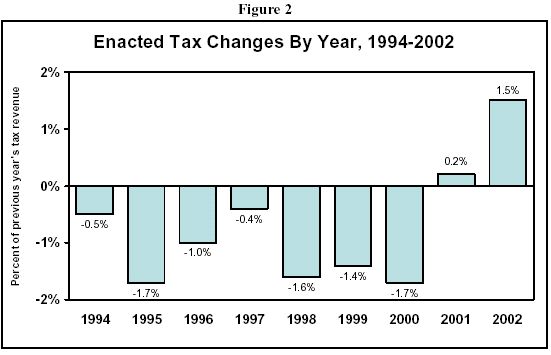

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

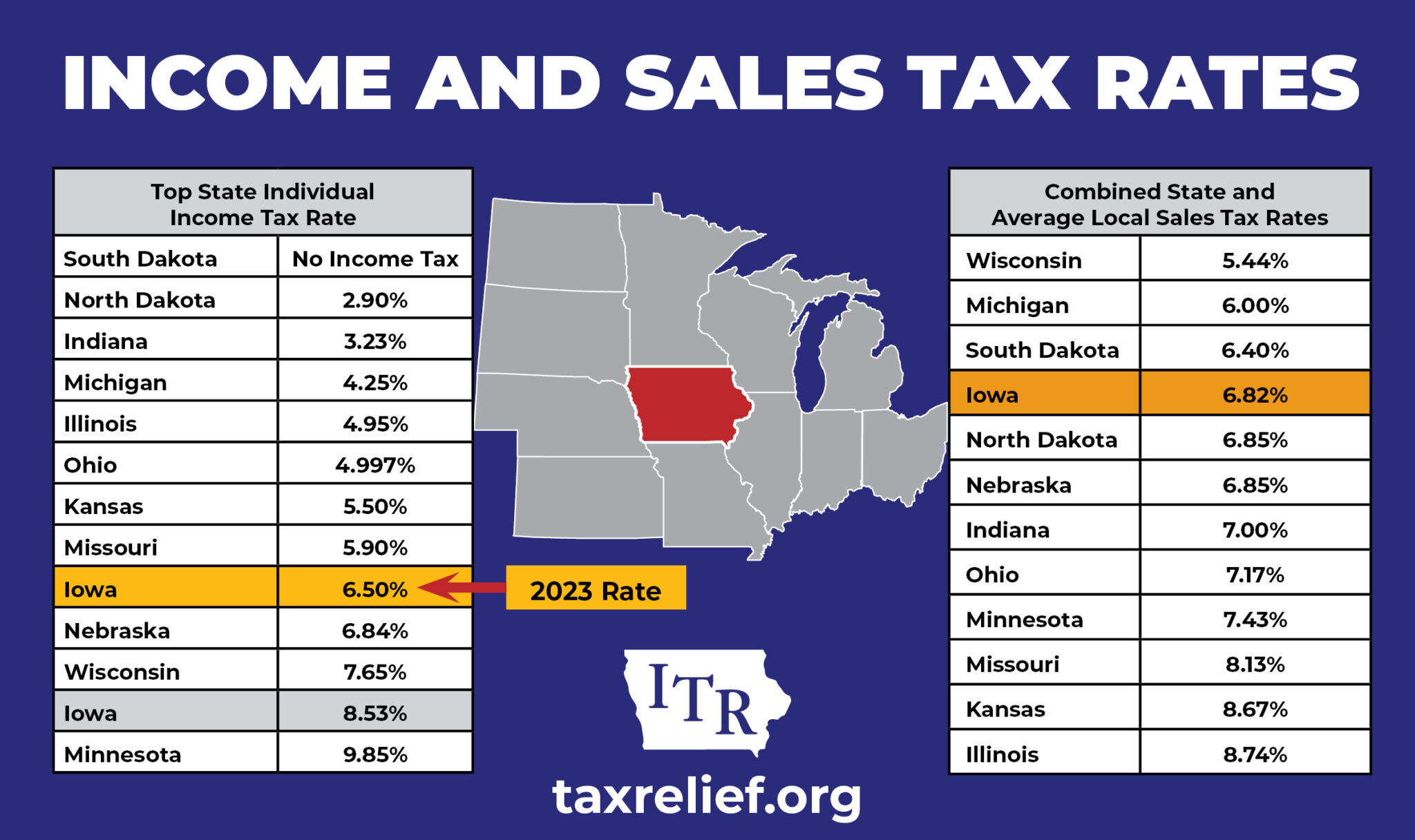

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

Compared To Rivals Nebraska Takes More From Taxpayers

State Corporate Income Tax Rates And Brackets Tax Foundation