cash flow from assets formula

Firstly determine the net income of the company from the income. The formula to calculate it is.

Cash Flow From Assets Definition And Formula Bookstime

Lets look at a simple example together from CFIs Financial Modeling Course.

. Every person in business needs to understand cash flow statement formulas and its importance for their companys growth. In a cash flow statement you will find information like. A cash flow statement is one of the most important accounting documents for small businesses.

So to calculate it divide the operating cash flow by the average value of assets in a company for a particular year. Cash return on assets cash flow from operations cfo total assets a higher ratio is better than a lower ratio when analyzing two similar companies cash return on assets tells how efficient a company is at employing its assets. Net Capital Spending 60 Change in Net Working Capital 300.

PPE 120000 170000 -50000. How to calculate the free cash flow to sales ratio. 3 Cash Flow Formulas.

The more free cash flow a company has the more it can allocate to dividends. Cash flow is often overlooked when people analyze a company. Cash flow from Investments formula Cash inflow from Sale of Land Cash outflow from PPE 30000 50000 -20000.

Operating Cash Flow. A cash flow statement is a record of financial transactions over time. It can help prevent the company from.

Add back all non-cash items. Shouldnt run into any problems. Capital Expenditure refers to fixed business assets like land and equipment.

Thats because the FCF formula doesnt account for. FCF represents the amount of cash generated by a business after accounting for reinvestment in non-current capital assets by the company. Operating Cash Flow Operating Income Non-Cash Charges Change in Working Capital Taxes.

Now lets use our formula. Cash flow to total assets ratio measure the ability of the company to use its own assets to generate cash flow. Operating cash flow is equal to revenues minus costs excluding depreciation and.

It is based on the accounting equation. Cash Flow Statement Formula. If you dont have the cash flow statement handy to find Cash From Operations and Capital Expenditures you can derive it from the Income statement and balance.

Calculating the free cash flow to sales ratio requires an additional step subtracting capital expenditures from operating cash flow. It also experiences an increase of 30000 of accounts receivable and an increase of 10000 in inventory versus an increase of 15000 in accounts payable. It requires two variables.

However the family wants to sell the company so they can retire. For example we already know that AAA Manufacturing Services operating cash flow is 11 million. Adjust for changes in working capital.

Operating cash flow formula. We can apply the values to our variables and calculate Cash Flow to Sales Ratio. Example of Cash Flow from Assets.

You can be a profitable company but if you dont have cash moving around to pay bills then you are really in trouble. While free cash flow gives you a good idea of the cash available to reinvest in the business it doesnt always show the most accurate picture of your normal everyday cash flow. Knowing your cash flow from operations is a must when getting an accurate overview of your cash flow.

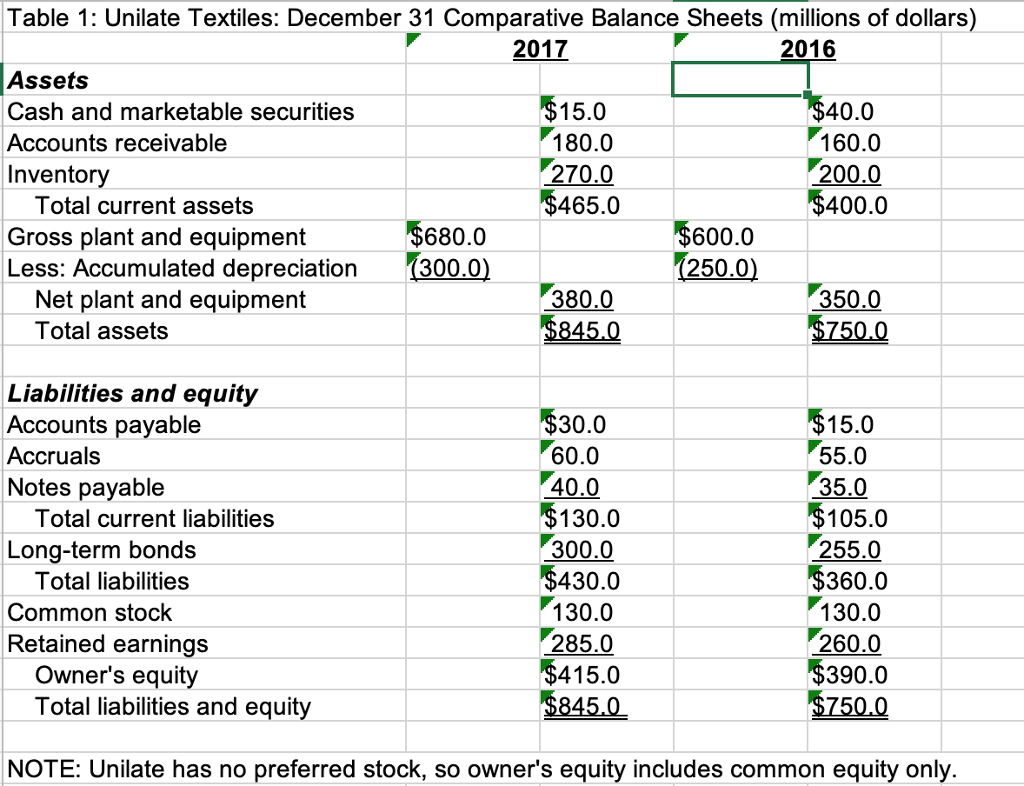

A business earns 10000 during the measurement period and reports 2000 of depreciation. A potential buyer wants to know Johnson Paper Companys cash flow assets from the past. Example of calculating cash flow from assets.

Cash ROA Operational Cash Flow Total Average Assets. In this case Whimwick Studios would have a Cash Flow to Sales Ratio of 35 for 2019. How to Derive the Free Cash Flow Formula.

Johnson Paper Company is a family company that sells office supplies. In this case depreciation and amortization is the only item. Operational cash flow and the average value of all assets.

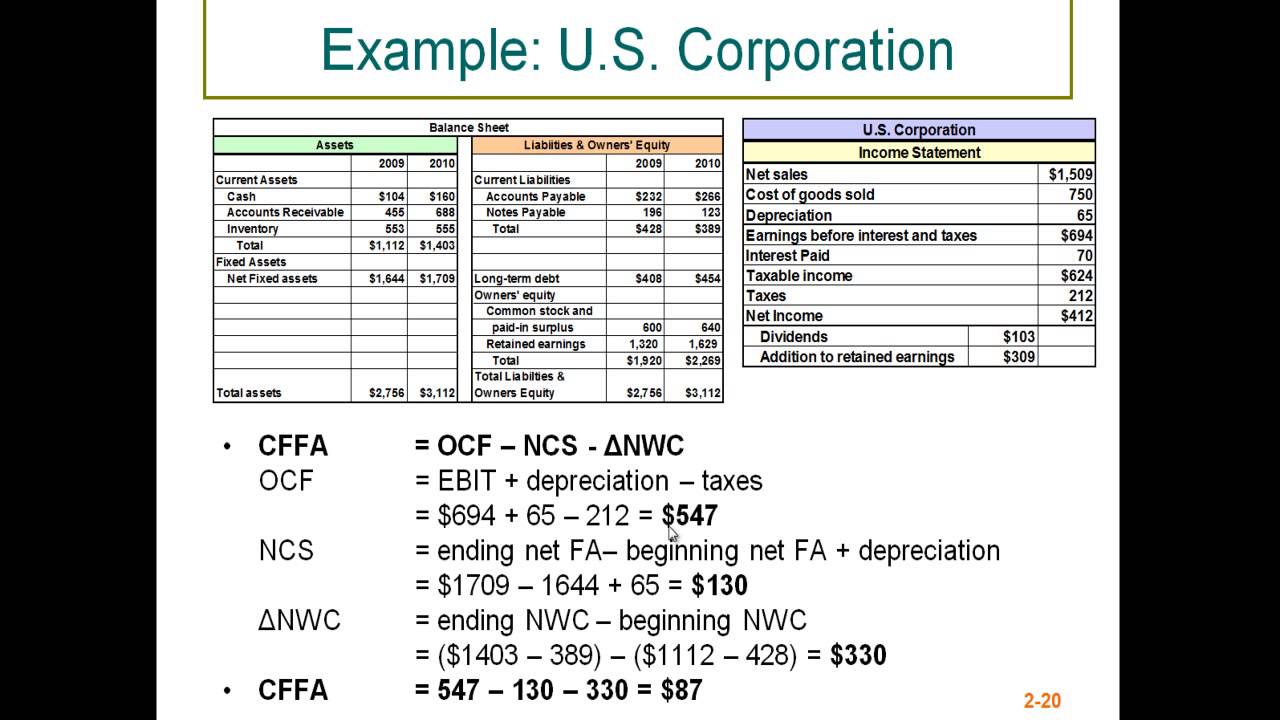

Equation for calculate cash flow from assets is Cash Flow From Assets f - n - w Where f Operating cash flow. 2 Indirect Method Operating Cash Flow Formula The indirect method is adjusted net income from changes in all non-cash accounts on the balance sheet Balance Sheet A balance sheet is one of the financial statements of a company that presents the shareholders equity liabilities and assets of the company at a specific point in time. 2574225799 Financial Management Formula Sheet Cash from Assets Operating Cash Flow Net Capital Spending.

Cash Flow to Sales 136200000 11600000 350400000. N Net capitalspending. But in the previous example we didnt account for.

The formula for free cash flow can be derived by using the following steps. A ratio of 030 30 is quite good Corys Tequila Co. Operating Cash Flow Operating Income Depreciation - Taxes Change In Working Capital.

Operating cash flow is the cash generated from a firms normal business activities. The more cash flow company generate it means the more efficient company use asset. Now that we have all the required values we can easily determine what Cash Flow from Assets would be.

Free cash flow FCF is the money a company has left over after paying its operating expenses and capital expenditures. Free Cash Flow Net Income Depreciation Amortization - Change In The Work Capital - Capital Expenditure. Operating Cash Flow investment in fixed assets investment in net working capital Operating Cash Flow.

Here are some examples of how to calculate cash flow from assets. Heres how this formula would work for a company with the following statement of cash. The resulting number would be your cash return on assets ratio.

Such non-current assets are not purchased frequently neither these are readily convertible into cash. Start calculating operating cash flow by taking net income from the income statement. W Changes in net working capital.

View Financial Management Formula Sheetpdf from SUPPLY CHA SCM103 at Sault College. The cash flow is the net between cash inflow and cash outflow from the company main business activities. Cash flow from assets is the total cash flow to creditors and cash flow to stockholders consisting of the following.

The formula would be. It relates a companys ability to generate cash compared to its asset size. Operating cash flow capital spending and change in net working capital.

Cash Flow Line By Line Long Term Assets Youtube

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Cash Flow From Operations Ratio Formula Examples

Cash Flow From Assets Definition And Formula Bookstime

Cash Flow To Assets Desjardins Online Brokerage

Cash Flow Ratio Analysis Double Entry Bookkeeping

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Solved Calculate The Cash Flow From Assets Cash Flow To Chegg Com

Operating Cash Flow Formula Calculation With Examples

Solved 2 Compute The Company S Cash Flow On Total Assets Chegg Com